Elisabeth

@0xcafeli

Followers

459

Following

1K

Media

36

Statuses

346

Co-founder @labs_compass 👩🏽💻| Physics PhD @UniofOxford 👩🏽🔬

London

Joined January 2020

DeFi's transparency is a superpower but only if you actually parse the data and act on it. The tools exist to monitor risk, automate responses, and construct resilient portfolios. The question is: are you using them?

0

0

1

3. Diversification is table stakes. Don't concentrate chasing yield. Spread exposure across uncorrelated assets, markets, and protocols, with different risk profiles.

2

0

1

2. Response speed matters. When red flags appear, you need automated systems to rebalance or exit positions immediately.

1

0

1

1. You need comprehensive market intelligence. Curators and allocators need to monitor vaults AND underlying market exposure, collateral quality, leverage ratios, liquidity depth. Manual analysis doesn't scale when you're allocating across markets.

1

0

1

Stream Finance situation shows why DeFi risk management needs to evolve. xUSD depegged from $1 to $0.16 with >$90M loss across protocols. This is a risk management failure by curators and allocators who didn't see warning signs or couldn't act fast enough. 3 things are clear:

1

0

1

We published a blog on why the best financial products of the next decade will run on crypto rails. At @labs_compass, we built the SDK that makes this possible. If you're building financial products and want to offer savings, credit, and trading that works 24/7, read this ↓

New blog published on how we're making DeFi accessible for fintech. Fintechs are embedding DeFi to offer better savings, credit, payment, and trading products. @labs_compass makes this happen with one SDK that handles the blockchain complexity.

0

0

4

Crypto went mainstream in 2025: - $46T stablecoin volume - 3,400+ TPS (100x in 5 years) - @Visa, @BlackRock, @jpmorgan all launching crypto But 716 own crypto, only 40-70M use it onchain. We're building the rails so any platform can deliver better banking via crypto rails.

Our latest State of Crypto report is here. The main theme for the year is the maturation of the crypto industry: • Traditional financial institutions and fintechs launched crypto products • DeFi and stablecoins went mainstream • Blockchains got faster and cheaper • The

1

0

2

That's exactly what traditional banks can't offer. That's the whole point of building on crypto rails. Otherwise, why leave your bank?

0

0

0

Whoever cracks integrated DeFi primitives, where every dollar can participate in and flow between products with fintech UX, wins the next billion users.

1

0

0

Why are crypto apps leaving money on the table? An Earn tab via Aave is great, but it's not enough. It's just a better savings account. Real DeFi means your $10k can SIMULTANEOUSLY earn yield, back a loan, or collateralize trades.

2

0

0

Billions coordinated by code across machines that don’t trust each other. People underestimate how big that is. In Tradfi this would literally be the banker calling the fund manager • hey can you post more collateral? • let me call you back • hey if you

Today, @aave experienced the largest stress test of its $75B+ lending infrastructure. The protocol operated flawlessly, automatically liquidating a record $180M worth of collateral in just one hour, without any human intervention. Once again, Aave has proven its resilience.

0

0

1

USDe "depeg to $0.65" is really a misnomer. USDe a tokenised fund running a basis trade, and settling multi billion $ positions in something that can swing +35% . Crypto industry would benefit from calling things what they are.

0

1

3

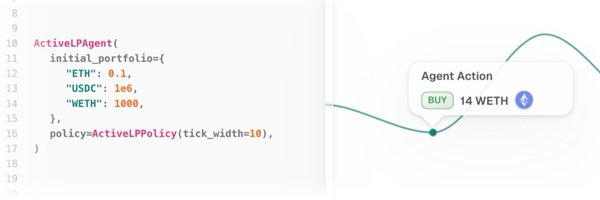

3/ This is the future we build for at @labs_compass: Compass SDK lets any fintech add DeFi (earn, borrow, leverage, and more) with a few lines of code. No protocol integrations, no new contracts.

0

0

1

2/ What this looks: - User in Argentina deposits BTC & earns yield - Borrows USDC against that same BTC (still earning yield) - Uses borrowed USDC for leverage trading All 3 working on the same capital simultaneously. No credit check, no regional restrictions

1

0

2

1/ Earn, Borrow, Trade - powered by DeFi - will be standard in every fintech & crypto app. Integrated primitives where every $ can participate in and flow between products. Accessible to anyone, anywhere. This is what traditional banks can't match.

1

0

3

For every neobank build on crypto rails: What users ask: - can I earn 8-10% on my money? - can I borrow some cash? - what’s the quickest way to send money to mom? What they don’t say: - can I use 4626 vaults? - can I bridge to an L2? - can I see the contract code? Better

0

0

3

ICYMI: Morgan Stanley’s Global Investment Committee now recommends allocating up to 4% of portfolios to crypto for growth-oriented investors — a clear signal that digital assets are entering the mainstream of portfolio construction.

6

16

73

8/ If you run payroll/treasury at a wallet, custodian, or fintech app and want this wired in without changing employee UX, DM me. We will put your float to work, and unwind it before the coffee’s brewed on payday.☕️

1

0

1

6/ Where @labs_compass API fits: one uniform API to route operational float to conservative venues across DeFi, custody-agnostic plugs, auto-unwind, and monitoring your Risk/Treasury will actually like.

1

0

1

5/ It generalizes beyond payroll: escrow, marketplace settlements, retainers, tax holds, subscription pre-funding, anywhere money sits between being funded and delivered.

1

0

0