Seco

@0xSeco

Followers

18K

Following

36K

Media

346

Statuses

9K

Ex-auditor @PwC. Accounting firm owner (NL). I write about money, investing & building businesses. DM or book an intake ↓

Joined March 2017

Investeren in NL? Optimaliseer eerst je juridische/fiscale structuur. COSK helpt investeerders met Holding/BV inrichting + volledig beheer — RA-kwaliteit, maximale controle, zonder gedoe. • 📅 Intake via link in bio • DM voor vragen

1

0

21

5. Box 3 is changing. Structures too. Want us to set up and maintain a BV + an accountant who’s always one step ahead? DM “BV” or book an intake via the link in bio.

1

0

2

4. Scenarios explained: 1. Box 3: no withdrawals, let it compound. 2. BV: no withdrawals, let it compound. 3. BV: withdraw €5k/year (small). 4. BV: withdraw €58k/year (living off it). 5. BV: withdraw €75k/year (you’re consuming the return).

1

0

0

3. Now the real test: €500k, 15% ROI, 10 years. I show net withdrawals, total tax paid, end capital. And Box 3 is calculated with the same withdrawals (apples-to-apples). Best case: a BV leaves you with ~25% (+€313k) more after 10 years.

1

0

1

2. The nastiest part of Box 3 isn’t even the rate. It’s that structure suddenly determines your compounding. below are the Break-even points of capital, when a BV beats the new Box 3.

1

0

0

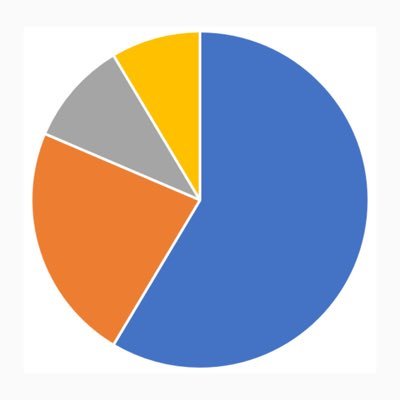

1. The Netherlands is “reforming” Box 3. In practice: a tax on returns + unrealised gains. So you pay even if you didn’t sell. Below is an Annual tax comparison (example: €500K capital, €75K return (15%)).

1

1

8

5. Box 3 verandert. Structuren ook. Wil je een BV + een accountant die de rest altijd een stap voor is? DM “BV” of boek een intake via link in bio.

0

0

6

4. Scenario’s in 1 zin: 1. Box 3: niks opnemen, alles laten staan. 2. BV: niks opnemen, alles laten staan. 3. BV: €5k p/j opnemen (klein). 4. BV: €58k p/j opnemen (leven van BV). 5. BV: €75k p/j opnemen (je “eet” je rendement op).

1

0

5

3. Nu de echte test: €500k, 15% ROI, 10 jaar. Ik laat zien: netto opnames, totaal belasting, eindkapitaal. En Box 3 is doorgerekend met dezelfde opnames (eerlijke vergelijking). In het beste scenario houd je met een BV ~25% (+€313k) meer over na 10 jaar.

2

0

11

2. Het smerigste aan Box 3 is niet eens het tarief. Het is dat structuur ineens je compounding bepaalt. Hieronder: omslagpunten — wanneer een BV beter is dan de nieuwe Box 3.

1

0

17

1. Nederland gaat Box 3 “hervormen”. In de praktijk betekent dit belasting op rendement + ongerealiseerde winst. Dus je betaalt ook als je niks verkoopt. Hieronder een jaarlijkse vergelijking van de belastinglast (voorbeeld: €500K kapitaal, €75K rendement (15%)).

8

2

51

All these layoffs worry me. Friendly reminder to build your own runway. Skills, savings and having options. Nobody is coming to save you.

4

0

45

They call it balancing mortgage interest deductions. You get taxed on the “profit” of living in your own house. NL is full of these benefits vs deductible expenses that cancel out. Most complicated system ever.

🇳🇱 In the Netherlands, homeowners pay tax on “imputed rent.” It’s called eigenwoningforfait. If you live in your own home, the government assumes you receive a financial benefit (because you don’t pay rent). A small % of your home’s value is added to your taxable income.

5

0

36

We keep arguing left vs right. Meanwhile the real divide is competent vs incompetent.

3

0

24

Jokes aside, let’s also zoom out. The Netherlands is still an incredible country: safe, prosperous, well-built, and full of people who get things done. We’ve got the talent and the systems to fix it. Let’s raise the bar again.

47

8

141

Yep. Lawful pressure works. Bezwaar - Woo - transparency - petitions. all legal.

Claude, Start an administration war against the Dutch tax authority Start with an custom objection, Request for payment, submit a Woo request to the Ministry of Finance regarding the feasibility test of Box 3 MAKE NO MISTAKE

4

6

44