wolf | Lending Supercharged

@wolf_indexed

Followers

709

Following

6K

Media

256

Statuses

1K

i like onchain | research analyst @redstone_defi

coffee shop

Joined October 2024

.@Token_Logic Aave analytics is absolutely great. Zero follow-up questions needed - they cover everything you could want to know about the protocol. The standard for the entire industry.

4

1

27

Sharing this because it's one of the most common @Dune beginner mistakes. Was hunting for a proper Aave TVL dashboard and found this community build: summing the 'amount_usd' column gives you deposit values AT THE TIME OF TX, not current values. Instead? Take the 'amount'

7

0

20

The incentive campaign breakdown 👇.

1/ $USDC & $WETH deposits and borrowings have hit all-time highs on Aave Base. For $USDC:.→ Deposits reached $185M.→ Borrowings reached $161.48M. For $WETH:.→ Deposits reached 96,500 WETH.→ Borrowings reached 86,730 WETH. The recent incentive campaign brought in fresh

0

0

0

.@aave absolutely crushed it on Base this week. 7.7% TVL WEEKLY growth. $90M fresh capital since the new incentive campaign launched. DeFi will win. 🟦

5

2

72

5/ Shoutout to @tokenterminal studio for the data. Made this breakdown super smooth to put together.

Just used @tokenterminal studio for the first time and am genuinely impressed with how straightforward it is. Good tool for high-level benchmark analytics without the usual hassle. Definitely worth a look.

0

0

3

1/ Quick context. Last week, Aave DAO launched migration incentives targeting Morpho's market share on Base. Morpho fired back immediately by ramping up their own rewards. Full backstory in the original thread.

🟦 wars begun. Why @aave just played a brilliant chess move against @MorphoLabs?. 👇

1

0

1

🟦 Wars Update: Week 1. The gloves came off last week. Both @aave and @MorphoLabs unleashed massive incentive campaigns targeted at Base users. One week later? Aave wins the battle. The breakdown 👇

6

3

27

Just used @tokenterminal studio for the first time and am genuinely impressed with how straightforward it is. Good tool for high-level benchmark analytics without the usual hassle. Definitely worth a look.

0

0

2

RT @redstone_defi: LENDING SUPERCHARGED. RedStone Atom is live. The first oracle with liquidation intelligence, designed for the needs of….

0

67

0

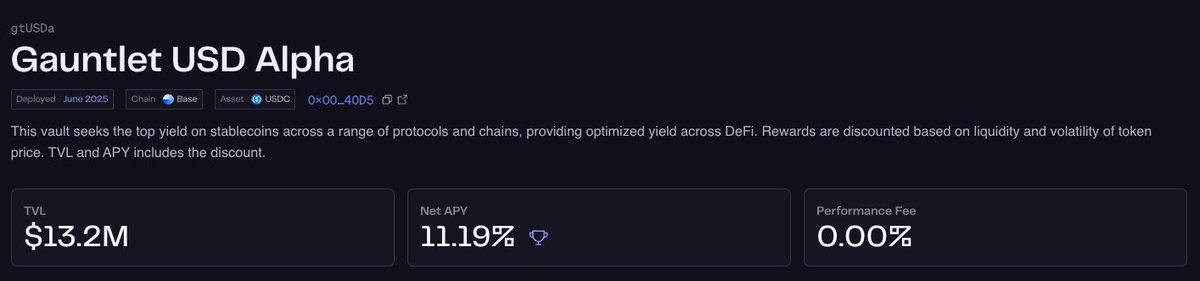

The best YBS (Yield Bearing Stablecoin) out there? . @gauntlet_xyz gtUSDa 🤌. @stablewatchHQ peep this one out.

12

3

27