Sonu Varghese

@sonusvarghese

Followers

10K

Following

25K

Media

2K

Statuses

11K

Musings on investing, the economy & all else. VP, Global Macro Strategist @CarsonGroupLLC. Advisory services through CWM, LLC, Registered Investment Advisor.

Chicago

Joined February 2011

Average effective tariff rate is ~ 10pp higher, after the pauses, pullbacks, & tacos. That was the "best case" scenario pre-Liberation Day 🤔We have the best case now + OBBB at the margin. So perhaps not a surprise that markets are at new highs & earnings expectations are 💪.

4

5

36

Great morning note from @philrosenn here 👇. Thanks for including my thoughts on the new market highs. Momentum works 💪.

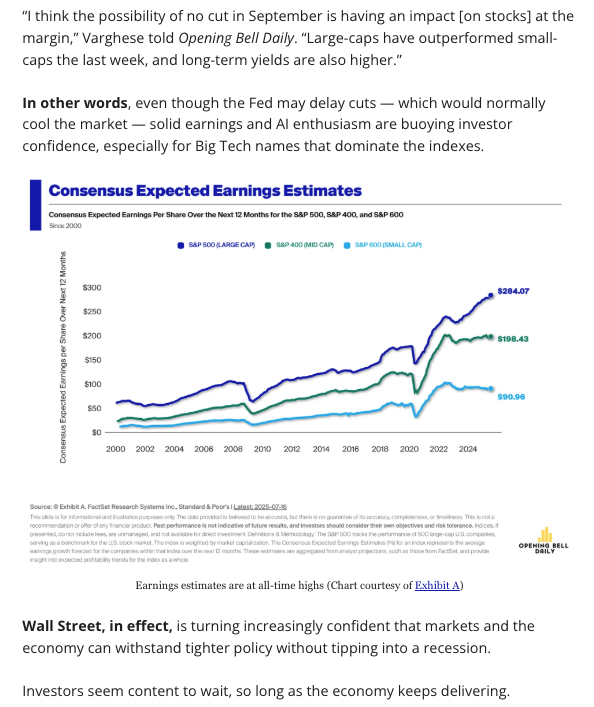

New newsletter: Stocks keep hitting records even as odds for Fed rate cuts go down. Strong economic data from inflation to retail sales have had the dual impact of making investors more optimistic while delaying any move from Powell. For investors, this is a momentum market.

3

7

25

RT @RyanDetrick: Jerome Powell is up against the ropes. @sonusvarghese explains why the walls are caving in around him. .

0

8

0

RT @JavierBlas: CHART OF THE DAY: America has an electricity problem. Retail power costs in the US are rising very, very quickly (>35% ov….

0

156

0

Adding to Neil's point . restaurant/bar sales ("food services") also impacted by higher prices. June.Sales: +0.57%.CPI - Food away from home: +0.44%. Last 3M (annualized).Sales: +1.3%.CPI - Food away from home: +4.7%. Real restaurant spending has flat-lined over the past year

Retail sales beat estimates, but enthusiasm ought to be tempered somewhat given the pick-up in consumer goods prices over the month. These are nominal dollar values. Core goods CPI ex autos rose 0.6% over the month. Real goods spending was soft in June.

1

1

11

😲. I imagine Powell would have to go home (unless he lives in the building, or "palace" as Trump calls it), and then Trump can block access to the building the next day. Or can Powell just work from home, as Fed Chair ?!?. So many questions . .

Removing Powell as Fed chair could lead to a messy, drawn-out standoff. The Fed owns its buildings and controls its security. If Trump attempts removal, Powell could try to stay until the courts uphold it or the Senate confirms a replacement.

2

0

7

Something that’s not talked about much in the context of tariffs …. Rising food prices 👇.

@sonusvarghese Food prices are broadly rising, in part due to tariffs (something I neglected to cover in my CPI thread). Wouldn't be surprising if restaurants are marking prices up accordingly.

2

2

16

Post-CPI/PPI June core PCE ~ 0.2-0.3% (2.7% y/y). Sep cut not a lock🤔. But couple of concerns for consumers 👇. Electric/Utls (energy services) .3M: +12% (annualized).12M: +7.7%. Restaurants (full service).3M: +5.8%.12M: +4.1%. Both in core PCE btw. @CarsonResearch @RyanDetrick

4

6

16

RT @darioperkins: reminder - tariffs will appear in the CPI before they appear in the PPI. PPI excludes imports and only captures tariffs i….

0

80

0

RT @RyanDetrick: Here are all the charts from when @sonusvarghese and I joined The Compound and Friends. @TheCompoundNews . Nice summary of….

0

7

0

3/ US customs allows importers who use the automatic payment transfer system (ACH + Periodic Monthly Statement) to delay tariff payments up to the 15th working day of the following month (after goods are released). So avg tariff rate in May/Jun was ~ 7-10% vs implied 15%+.

New Treasury data show US raised $26.6B in tariff revenue in June 2025. We were raising ~$7B/m before the new tariffs, so we've raised ~$20B in revenue in June alone & ~$45B in 2025 so far from 2025 policy. Average tariff rate in June was 10%, vs. 15.7% policy-implied June avg

2

0

9

A few reasons behind the disconnect between tariffs & inflation 🧵. 1/ Big tariff increases went into effect only in April. But goods already shipped were exempt. Takes ~ 1 month for imports from Asia to reach US. So big tariffs would really have began to hit only by mid-May.

Could this explain some of the disconnect between announced tariffs and inflation? JP Morgan finds U.S. realized effective tariff much lower than the announced tariff, likely due to importers substituting away from higher-tariff countries & products.

6

8

50

RT @JeremyWillner: If you have the time this is a great episode @TheCompoundNews with @Downtown @michaelbatnick and our team @RyanDetrick @….

0

7

0