shirish sawant

@shirishsawant

Followers

44

Following

9K

Media

59

Statuses

2K

Learner @Finance, Mutual Fund Distributor.

MUMBAI

Joined July 2009

🚨ROC Annual Filing Extension!! MCA has issued Circular No. 06/2025, dated 17 October 2025, granting relaxation from additional fees and extending the due date for filing the following e-Forms for FY 2024-25 to 31st December 2025! ➡️ MGT-7, MGT-7A ➡️ AOC-4, AOC-4 CFS ➡️ AOC-4

1

9

32

Finish your home loan 5 years early without changing your EMI. Sounds impossible? It's not. A Home Loan Overdraft uses your existing savings to slash interest costs, while keeping your money accessible for emergencies. Read Everything you need to know in one article:

3

47

196

NPS saves your future generation from capital gains tax which they will have to pay in mutual funds & stocks. We've created a community for NPS at @thefynprint Please fill the form & join https://t.co/21BupALCg3

29

62

359

India needs serious financial literacy! Some arguments in the below post is that 1L was too much in 1995 & how many people had it? My friends, had you invested 100 also & held on, your returns would have been 22% in the fund. The message in the below post is not 1L and 4cr,

A 1L investment in the Nippon India Growth / Midcap Fund would have become a little over 4cr in 30 years. That is 400 times in 30 years. A CAGR of staggering 22% for 30 years. But I can guarantee you that if I take you back to 1995 & you have to start investing in the fund

56

27

482

Been using @comet for 2 months... By far the most superior browser out there🤯 I don't understand why more people aren't talking about it... @AravSrinivas @perplexity_ai 🧵10x your productivity with these simple shortcuts:

36

48

593

Given all the changes in EPF, I'm reposting a story we did in Mint. You can opt out & stay out of EPF, if you are not already a member even if your company > 20 employees & is under EPF. You can keep & invest your own money. https://t.co/ITVx4VZMNV

24

103

387

Having many funds may not give you much value. Why? The same stocks are there across funds! Read more here: https://t.co/epJ3Qd3x98 If you would like to join our personal finance community, fill: https://t.co/nLI6wRbSVh

19

34

202

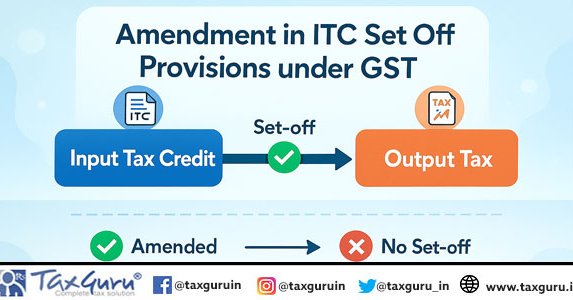

Amendment in GST ITC set-off rules: IGST credit must be fully used first, then CGST & SGST/UTGST in order. IGST can offset any tax; CGST & SGST can’t cross-adjust. Smart utilisation of IGST between CGST/SGST helps reduce cash outflow. #GST #ITC

taxguru.in

Summary of GST Rule 88A and Section 49 governing ITC utilization. Explains the mandatory order of set-off and the strategic use of IGST credit to reduce cash payment.

2

18

68

Terrible news. Nepali Hindu hostage Bipin Joshi has been killed by Hamas terrorists in Gaza. When grenades were hurled into his bomb shelter on 7th October 2023 by Hamas terrorists, Joshi grabbed one and threw it out before it exploded, saving lives in his final known act of

1K

7K

34K

🚨 One of the Most Beneficial Changes in GSTR-9 for FY 2024-25 - Column A1 of Table 6 ➡️ Taxpayers can now report Input Tax Credit (ITC) pertaining to the previous financial year that was claimed in the current year’s GSTR-3B. Earlier, there was ambiguity regarding where and

8

40

234

How to cover your children properly with health insurance. For starters, add them to your existing family floater 90 days after birth. Story by @VedantVichare99

https://t.co/tuEKcU0hfJ

6

56

292

When You Start Making Good Money, Do This: 1. Buy fewer clothes, but wear the highest quality. 2. Eat premium food, not junk 3. Hire a helper for household chores. Buy back your time. 4. Upgrade your mattress. Sleep changes everything. 5. Invest in experiences, not just stuff.

134

4K

25K

🗒️GST Practical Guide with Example ITC Not Allowed if Depreciation is Claimed on Tax Component. For Example: - Case 1 — ITC Claimed ➡️You purchase machinery for ₹1,00,000 + GST ₹18,000 (Total ₹1,18,000). ➡️Here, you claim ITC of ₹18,000 in your GST return ➡️So under

4

20

128

Important Dates for Professionals – October 2025 1. 7th October - TDS/TCS Payment - ✅ 2. 11th October - GSTR-1 Due Date - ✅ 3. 13th October - GSTR-1 (QRMP) 4. 14th October - ADT-1 (ROC) 5. 15th October - TCS Return Q2 6. 15th October - EPF/ESIC Return 7. 18th October - CMP-08

3

27

121

🏢 When Does Tax Audit Become Mandatory? Every taxpayer doesn’t need a tax audit. But if your turnover or income crosses certain limits — it’s compulsory. Let’s decode it section-wise 🧵👇 1. Section 44AB – The Tax Audit Section ➡️Tax audit = Examination of your books of

15

60

274