Rohan Hirani

@rohanhirani

Followers

4K

Following

22K

Media

141

Statuses

742

@bitcoinquant_ | Past: Bain & Co, PwC, U of Illinois Finance

Miami, FL

Joined June 2019

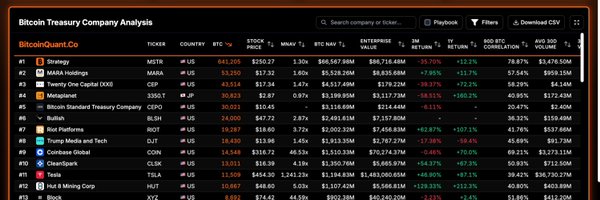

Bitcoin Treasury Twitter had a major gap. Sites showed BTC holdings, but none surfaced many key metrics needed to properly value these companies - volume, volatility, options data, market returns, and more. We built https://t.co/aIhGju8dJG to close that gap 📊

110

261

1K

I’ll be part of a few discussions at @bitcoinmenaconf this week covering corporate and Gen Z Bitcoin adoption. If you’re around, say hi

2

0

12

There are a lot of “almost-bitcoiners” who finally become convinced that Bitcoin has real value… but instead of buying, they get stuck trying to time the perfect dip. They wait for: - a dip - a deeper dip - confirmation of the dip - a dip after the dip And while they’re

8

10

62

If 5% of US taxes are paid in BTC and the gov holds that BTC for 20 years… America could theoretically wipe out the entire national debt without purchasing a single Bitcoin. Let that sink in. Massive respect to @WarrenDavidson and @bitcoinpolicy for championing this vision.

77

25

203

Strategy’s story is not unique. In the mid-2000s, Apple accumulated $1.25B of NAND flash memory contracts (the storage chips needed for iPhones). Analysts mocked them for “overcommitting” to a commodity part that didn’t seem scare or too important at the time. Then the iPhone

22

44

449

When are institutions going to realize the risk isn’t Bitcoin? It’s the system they’re sitting on. You can’t hedge sovereign debt chaos with… more sovereign debt. You can’t hedge cash debasement with… more cash. You can’t hedge structural inflation when the inflation is the

3

11

69

The most requested chart is finally live… MSTR’s mNAV since the beginning of their BTC strategy. It shows market cap vs BTC holdings with a whole new layer of context.

11

18

164

More charts for all BTCTCs at

bitcoinquant.co

Track public Bitcoin holdings with mNAV, volatility, volume, debt, and 30+ more metrics

2

1

7

650k BTC + $1.44B USD reserve. A balance sheet built for war.

129

325

3K

I hung out with two family members who are MDs at Citi and Goldman. Neither of them have ever heard of “MicroStrategy” or Michael Saylor. The biggest story in all of finance… and completely off the radar of people running global banking divisions. And even after they hear

68

24

539

Recent convos have reiterated the following: Most people’s investment narratives are backfilled. Ex: when BTC goes up, people feel safer agreeing with it. When it goes down, they feel safer rejecting it. Their belief follows price, not the other way around. People rewrite

5

5

49

Yesterday’s convo was about JPM feeling pressure from Strategy’s digital credit products. This morning, JPM unveiled their own Bitcoin-backed structured note. We’re living through the financial system updating in real time. Blink and you’ll miss it.

I mean… what did people expect? You don’t just walk into the $150T fixed-income cartel and sustainably offer 8-12% yields without making some enemies. JPM is just the first domino. Those who’ve spent decades selling investors a “safe” 2–4% yield are not going to sit quietly

4

6

97

I mean… what did people expect? You don’t just walk into the $150T fixed-income cartel and sustainably offer 8-12% yields without making some enemies. JPM is just the first domino. Those who’ve spent decades selling investors a “safe” 2–4% yield are not going to sit quietly

93

261

2K

“Bitcoin was used by criminals like Epstein!” Who cares?? Criminals used the V8 engine so they could outrun cops with slower cars. Criminals used the telephone because they were harder to trace than landlines. Criminals used the early internet because law enforcement wasn’t

5

7

64

Monday morning Proof of Work. Let’s get after it this week 🚀

2

1

28

Wholeheartedly disagree. That tweet is the universal Bitcoiner origin story. I have never met a real Bitcoiner who didn’t start as a skeptic. Bitcoin sounds insane the first time you hear it. No government. Fixed supply. Anonymous founder. Of course you compare it to

$MSTR Michael Saylor needs to delete this 12 yr old tweet people keeps bringing back to life. Lol. @saylor, it literally takes two seconds.

26

30

349

The reason why the conversation about Strategy is always about the worst-case scenario is because they cannot bear to see Bitcoin win. Bitcoin winning means syphoning the monetary premium away from every other asset, including Gold. They see Bitcoin as competition.

Why is the $MSTR conversation always about worst-case scenarios? It’s always “Oh no! What happens if Bitcoin drops 90%?!” Same energy as “BiTcOiN WiLL fAiL iF tHe InTeRnEt GoEs DoWn!!” Technically possible. Practically… c’mon dude.

4

6

42

Why is the $MSTR conversation always about worst-case scenarios? It’s always “Oh no! What happens if Bitcoin drops 90%?!” Same energy as “BiTcOiN WiLL fAiL iF tHe InTeRnEt GoEs DoWn!!” Technically possible. Practically… c’mon dude.

According to @Saylor, if Bitcoin goes down 90%, $MSTR will be fine. In the unlikely event his claim is true, shareholders won’t be fine losing 90% of their investment. In fact, with Bitcoin down 90%, MSTR will likely trade at a huge discount to its Bitcoin, exacerbating losses.

16

2

85

Had a great time chatting about magic internet money, and excited to continue to convo with Fin on Stage at @bitcoinmenaconf

🎙️ Just dropped the LATEST podcast with @rohanhirani If you’ve ever thought Bitcoin was “too complex” or “too risky,” this episode will flip that upside down. Here’s what we cover: - Why Rohan ignored Bitcoin… and what finally made it click - The importance of self-custody -

3

1

16