🧵 How do I calculate Total Addressable Market (TAM)?

A key question VCs must answer to determine the penetration needed to reach a certain level of revenue to return the fund

Many do a top down approach, when a bottoms up approach is needed

Analysis 👉🏽

26

75

546

Replies

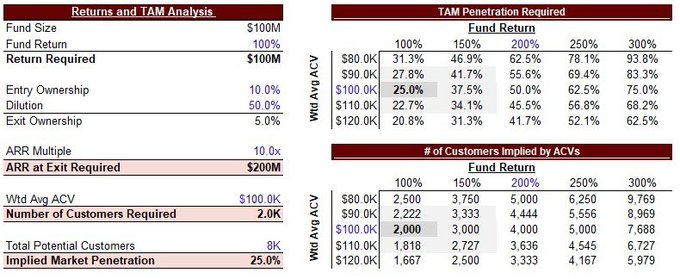

So let’s do some simple math, the assumptions

Market Assumptions:

- $10B TAM

- 10k customers in market

VC assumptions:

- $100M fund

- 10% entry ownership

- 5% exit ownership (50% dilution)

- $2B outcome to return the fund ($100M/5%)

- 10x ARR multiple

- $200M exit ARR ($2B/10x)

1

0

11

Based on these assumptions we are solving for what must be true for this startup to get to $200M ARR. In regards to TAM that means

- How many customers are needed?

- What penetration is needed?

The top down calculations are

- Revenue / TAM = penetration

- $200M / $10B = 2%

1

0

9

This approach assumes that all dollars spent are already equally across the 10k customers

This would imply a $1M ACV (Average Customer Value) or $10B/10k

However, most markets follow the 80/20 rule. 80% of spend is by 20% of customers so the ACVs are much lower for most

1

0

7

In reality, there are prob 2k (20%) customers with $1M+ ACVs and 8k (80%) customers with $100k+ ACVs

Most startups can’t serve both markets so it’s important to know exactly the target customer profile.

We have seen a majority of B2B target the $100k+, not the $1M+

1

0

6

So the bottom up calculation is

- Target customers x ACV = TAM

Simple math then is

- 8k customers x $100k ACV = $800M TAM

- $200M ARR / $800M TAM = 25% penetration

25% penetration is much harder to get than 2%

1

0

6

Some market shares of the biggest companies

Google 92%

Uber 72%

Apple 62%

Doordash 59%

Netflix 45%

TikTok 44%

Amazon 38%

Spotify 31%

Salesforce 24%

Snowflake 20%

Slack 18%

Shopify 11%

Workday 8%

It’s hard to get 25%+ penetration, but possible. We don’t model more than 10% tho

4

0

12

It’s important to note that the highest market shares are largely consumer focused companies. It’s much harder to get 25%+ for enterprise given those often aren’t winner take all markets

Keep that in mind depending on what industry you are building in

2

1

8

Ultimately, the total market spend is less relevant bc every customer will have a spend cap for your product regardless of their size. A 10x larger company won’t have a 10x ACV

There will be a distribution curve of customer sizes and ACVs, I used averages for simplicity

1

1

9

Try to determine the number of available customers based on your target profile. This will be much more informative to determining your true TAM

Want to learn more, follow me

@hpierrejacques

2

0

11

@hpierrejacques

This is good. Do you underwrite each investment to 1x the fund as opposed to say 10x the investment?

2

0

3

@roosontheloos

Yea we stopped caring about MOIC. Coming from PE that was what we thought mattered, but ultimately dollars returned are what matter. 10x on $2M initial check for $100M fund can't be the winner. We typically model 50% of fund as base case and 100% as upside case

1

0

5

@hpierrejacques

Is targeting the larger pool the better option? Or should they be targeting the larger customers?

1

0

0

@Bmosier4

Most can't start with larger customers given product requirements, sales cycle, cash for sales team. Might be able to move upstream over time though

1

1

3

@hpierrejacques

are there different assumptions used for # of customers implied by ACVs when pushing for a fund return of 300%?

1

0

0

@knycksutherland

Either you would need 3x the customers or you have to move upstream to larger ACV customers

0

0

1