Explore tweets tagged as #seagen

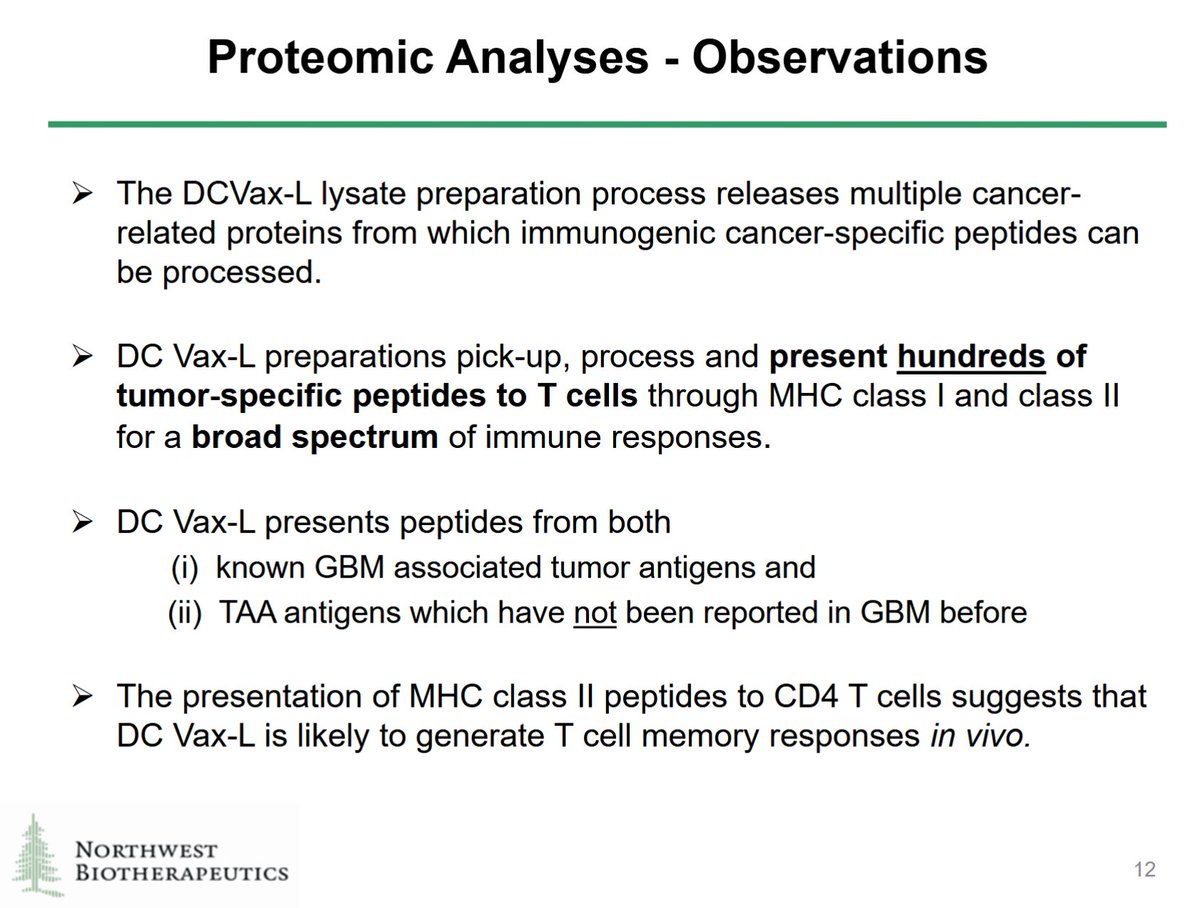

@sciqst Question: Had $NWBO given the following presentation in June 2022 instead of June 2023, would Pfizer still have acquired Seagen?.

0

0

10

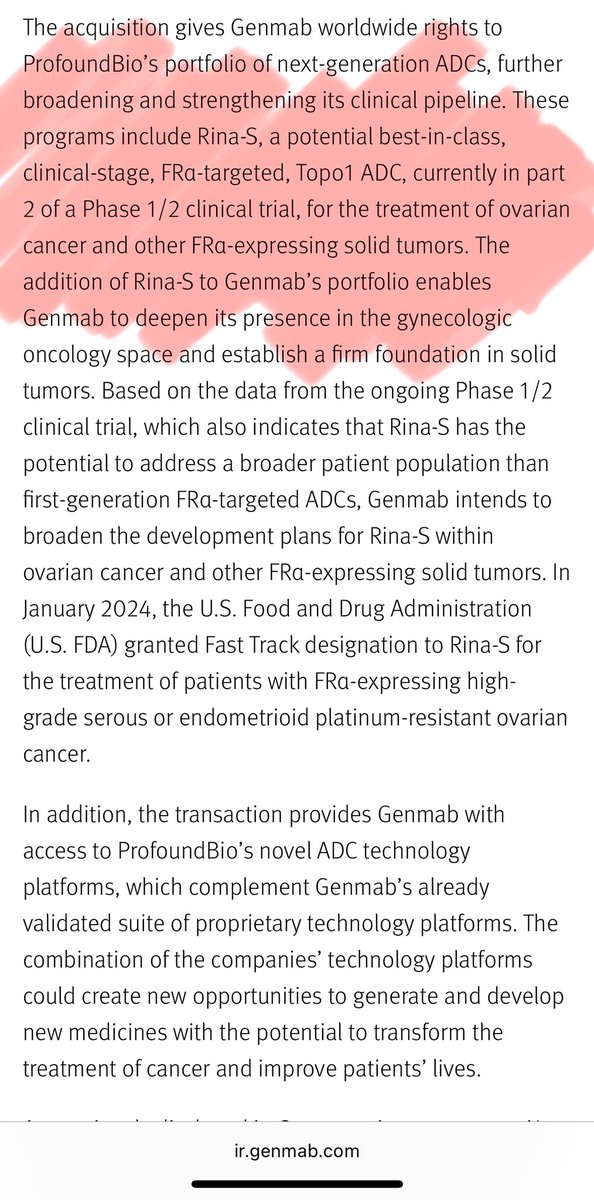

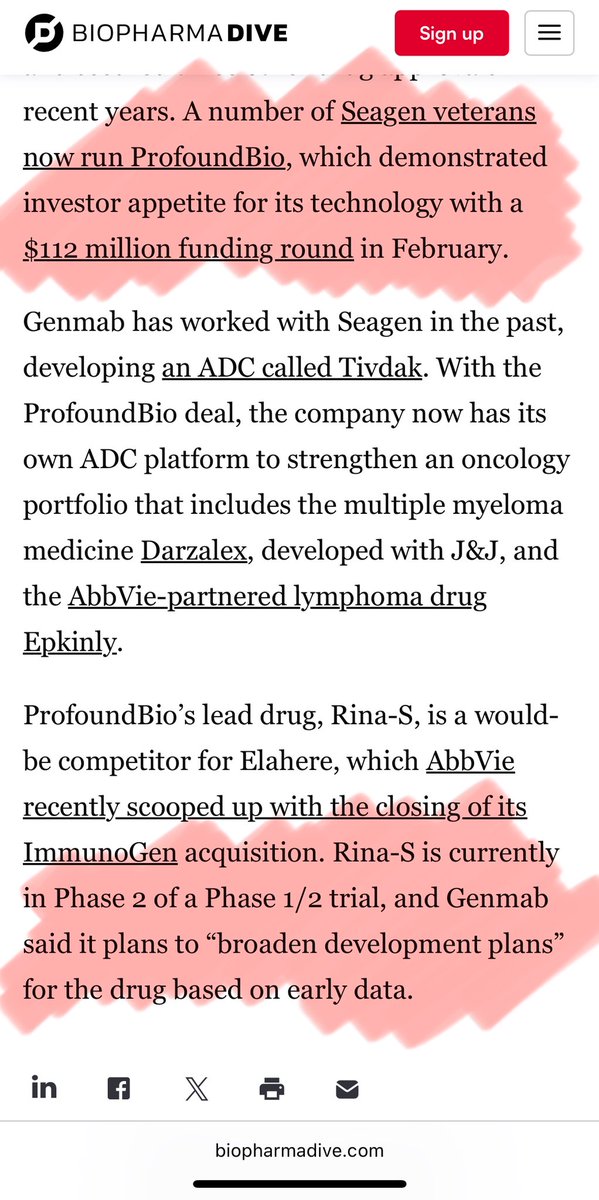

#AVCT. This is what $1.8Bn looked like last year:. Profound Bio was a ADC startup led by Seagen veterans, founded in 2018. It had two rounds of funding. Series A - $70m; Series B - $112M (February 2024) . ProfoundBio was taken over two months after their series B funding in

0

3

41

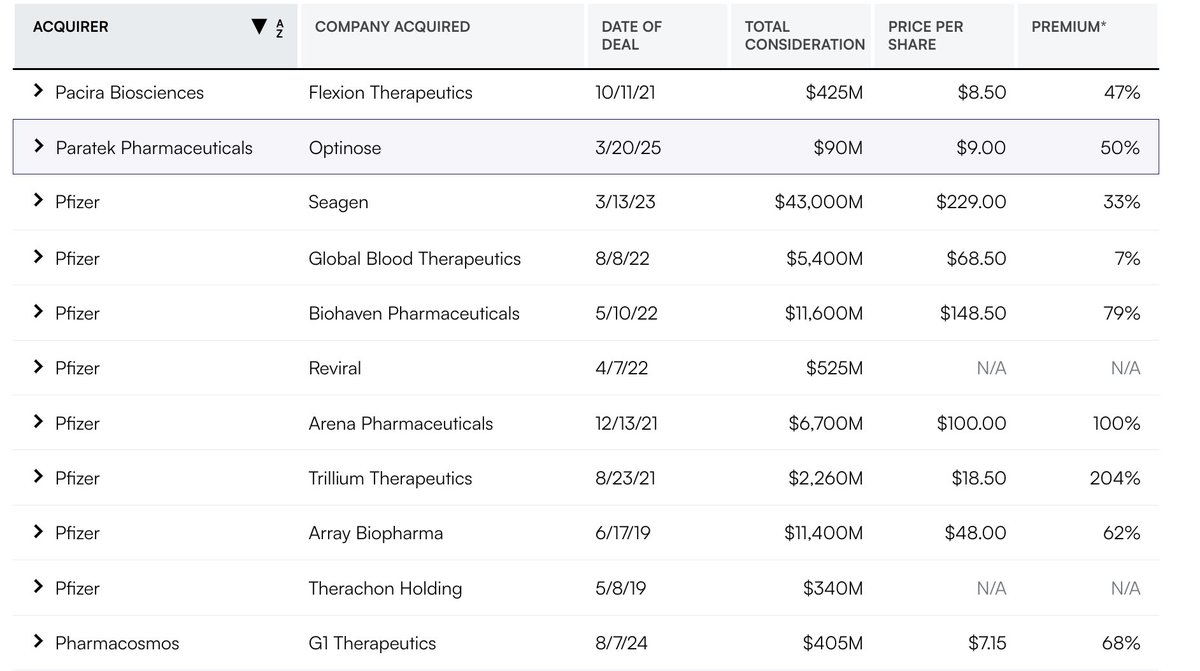

@grok @vendedoruruguay @SenseReceptor @RobertKennedyJr @US_FDA @pfizer @Jikkyleaks @Kevin_McKernan Kevin McKernan exposes Pfizer's bait-and-switch:.They used a clean batch for trials… then injected the world with process 2 — loaded with SV40 promoter sequences. They hid #SV40 from the @US_FDA. Then @pfizer bought Seagen, a cancer treatment company, for $43 billion. > “This

1

1

2

#NWBO I know, I know is Chat GPT, but still:.In my opinion if NWBO is apporved for all solid tumors, with Autologous manufacturing scaling, US + EU + China + Japan + Latam. with reimbursement, the valuation shoul be much more than Seagen.

5

0

45

In other news,.Pfizer acquired SeaGen and Trillium.

Week 11 2025 Cancer Mortality Update. 🚨Cancer mortality is officially exhibiting a non-linear rise trajectory. I was waiting to make this observation, first out of conservancy, but also from a hope that it would not even manifest. However, cancer is now accelerating mildly.

14

108

310

Merck terminated the collaboration with Seagen after spending $1.6b and signed a deal with Daiichi by paying $5.5 bln, and potentially up to $22 bln for its three ADCs as claimed in the PR. Do Daiichi's ADCs outperform Seagen's to such an extent that Merck was willing to switch

Merck spent $1.3b on the acquisition of Imago for its LSD1 inhibitor. See how LSD1 inhibitor can affect DC function. It seems like Merck has been collecting all the components complementary to DCVax products. Lysine-specific demethylase 1 (LSD1) inhibitors can modulate

1

0

12