Explore tweets tagged as #OrderBooks

Just find out a new prep DEX where you can get a potential airdrop . Introducing @PolynomialFi. They just launched sth called Polynomial Fusion where limit orders run on orderbooks and market orders run on AMM. About Polynomial. -> Polynomial raised $1.1M .-> Backed by Paul

2

0

3

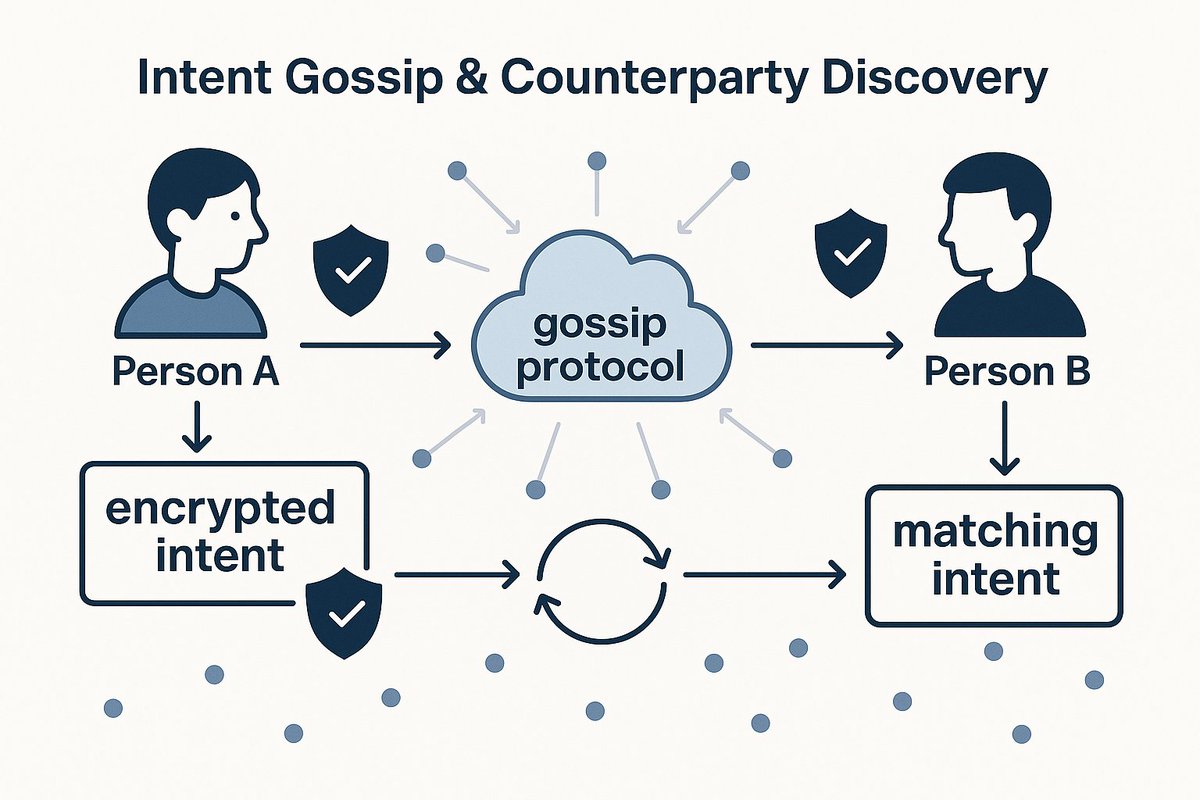

How do users on @anoma find each other to trade without relying on centralized orderbooks?. 🔍 Enter Intent Gossip & Counterparty Discovery:. A decentralized protocol where user intents propagate privately until a match is found. #Anoma #modularblockchains

6

0

8

Day 4 – App #4: Monorail. Today’s app is Monorail a DEX aggregator built on the Monad testnet. It finds the best prices across multiple exchanges and lets you swap smoothly, all from one clean interface. What makes it special? Monorail combines onchain orderbooks and AMMs the

1

0

3

Wanna know why apps like @_WOOFi and @RaydiumProtocol trust @OrderlyNetwork?. Because it just works. Built-in liquidity, low-latency orderbooks, onchain execution. Infra so good, you barely notice it. That’s the point.

38

10

118

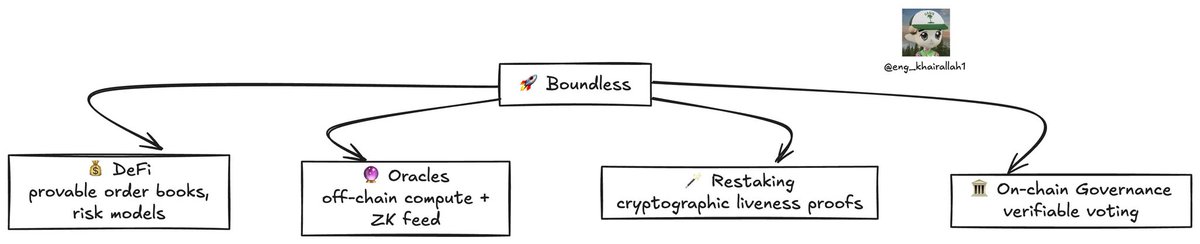

what can you build on @boundless_xyz?. • defi — zk orderbooks, provable risk models too heavy for evm. • oracles — off-chain compute + zk feed, no trust leaps. • restaking — cryptographic liveness proofs; slash idle avs nodes. • governance — gas-light, verifiable voting at

30

4

53

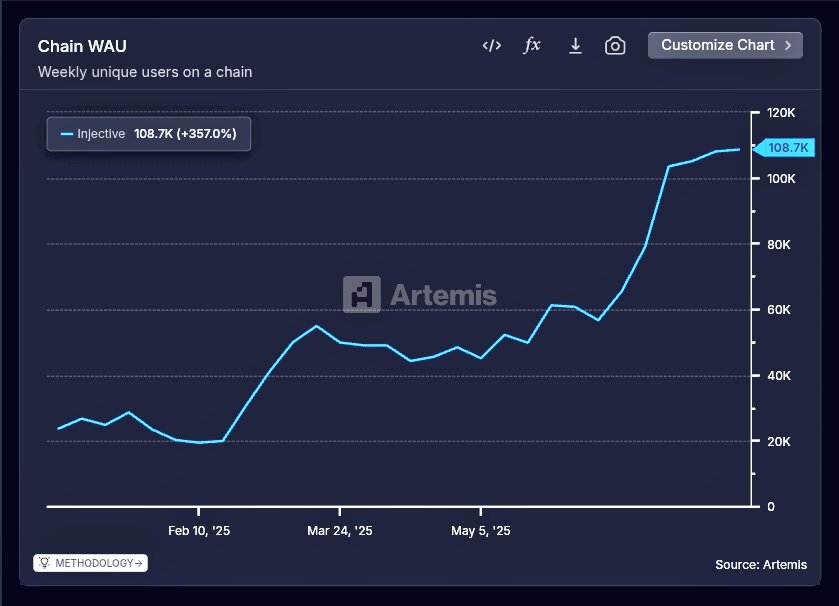

So, @injective is a layer-1 blockchain purpose-built for finance, offering ultra-fast speeds, zero gas for users, and native interoperability. It enables fully onchain orderbooks, derivatives, AI dapps, RWAs, and DeFi apps to scale seamlessly across ecosystems EVM SVM CVM

Daily Active Users up since January: DAUs spiked from ~135k address, yet @injective's price stayed flat in the $13–$16 band, I am expected this to go up higher as altcoins season and tradfi picks up. RWA tokenization scaling: Helix DeFi now lists 25+ tokenized real-world assets

29

2

40

🧵 ELI5 of @Timelock_Trade’s novel mechanism. > eliminates flaws in traditional leverage mechanism like orderbooks (@binance, @HyperliquidX & peer-2-pool @GMX_IO. [centralization, oracle, counterparty risk, MM dependance, governance]. Timelock's Alpha:.> taps into Uniswap's

1

0

4