Nimblr

@Deishma

Followers

83K

Following

53K

Media

20K

Statuses

118K

Lead Investor & Prop Desk Trader | FA & TA | Founder-Nimblr TA Open Source (on Blog) Candlesticks & CCI Master

Mumbai, India

Joined June 2015

Updated Learning + Scanners Shared so far... for X Family. For Trading Guidance Bookmark this & Hit Like for more.... 1. Finding High Conviction Stocks Part - 1 https://t.co/9sweRqqbij 2. Finding High Conviction Stocks Part - 2 https://t.co/3iOny4x8QM 3. The Golden Rule

Finding High-Conviction Stocks! - Part 2 Important Learning #5 The other remaining points: 5. Insider Trading (Buying vs. Selling) → Net Positive in Last 6 Months More insider buying than selling signals internal confidence in stock growth. 6. Sector Rotation Strength →

0

36

129

Never chase a breakout candle. The entry is in the acceptance zone AFTER breakout, not the breakout moment. #Nimblrprocess #StockMarket

1

1

22

When EMI stops. Suddenly salary becomes YOURS. Debt-free is the new rich. #lifestyle

4

4

35

Biggest wealth hack: If you can’t buy it twice without loan, You can’t afford it once.

0

3

26

My personal newsletter group - pure content. Thank you for all the members:

0

0

8

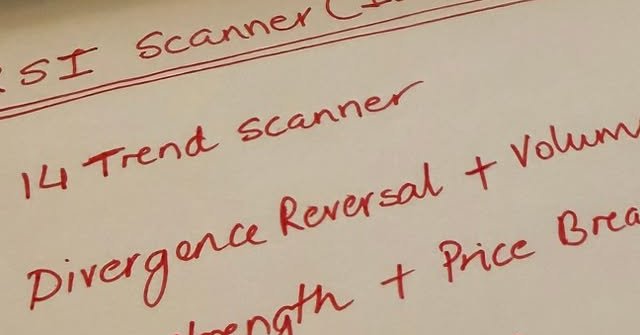

On Public Demand, building a Free RSI Scanner. Have short listed few of them but cannot decide which would be the most useful to all. Kindly comment on the link below and shall build one for all. Link below #StockMarket #RSI

1

0

25

Over the last 14–15 months, the Small & Micro Cap index has quietly been the worst performer, despite many companies doubling their PAT. That’s the trap: Price ≠ Performance. Diversification across market caps isn’t just theory, it’s survival. FlexiCap funds exist for this

0

2

20

Breakouts with volume spike + CCI 14 acceleration + CCI 34 staying stable - strongest continuation setups. #StockMarketIndia #Nimblrprocess

0

1

19

“Nothing happens below the 200-day EMA.??? REALLY?? Sounds cool, but it’s only half truth. Below 200EMA: – Weak trend, low conviction – Institutions avoid building big positions – Breakouts often fail, volatility is higher – Risk-reward is rarely in your favour But, early

1

2

23

Private Capex Revival means that private companies (not the government) have started increasing their investments again in building or expanding things like: Factories Infrastructure Machinery & technology Warehouses Supply chain & logistics Employment & capacity In simple

0

1

20

“If Securities Transaction Tax (STT) is removed, the small-cap index can boost. What does this mean? STT adds a cost to trading/investing. Lowering or removing it might boost liquidity, trading volumes and investor participation. More money/investor interest = greater buying

1

1

15