David Lubin

@davidlubin

Followers

807

Following

47

Media

0

Statuses

49

Senior Research Fellow, Chatham House; ex Citi’s Head of Emerging Markets Economics. Author, “Dance of the Trillions: Developing Countries and Global Finance”.

London, England

Joined December 2008

"BRICS membership offers a soft way of engaging in strategic balancing. For many countries, BRICS membership is a way of tilting towards Beijing without doing much to upset Washington." @davidlubin (@ch_gef) on the appeal of BRICS to non-western countries, via @BBCNews.

1

3

10

The EU’s embrace of both a central bank digital currency and private cryptocurrencies could be a more promising strategy than either China’s or the US’s exclusive focus on one or the other, writes @davidlubin. https://t.co/3oTPmxTwmJ

chathamhouse.org

The EU’s embrace of both a central bank digital currency and private cryptocurrencies could be a more promising strategy than either China’s or the US’s exclusive focus on one or the other.

0

3

9

"If Trump can implement this vision of withdrawing the United States from the world, it's very difficult to imagine big economic powers stepping up." @davidlubin (@ch_gef) on whether 🇨🇳🇪🇺 can replace the US as the world's importer. Watch in full: https://t.co/2Z21otpA8b

0

4

7

The Nigerian naira is more competitive now than it has been for 25 years. Best keep it that way: much wiser for the currency to be undervalued rather than overvalued. My piece for Chatham House. https://t.co/QAiviulILT

chathamhouse.org

To secure long-term growth, the government must resist the temptation to fight inflation by letting the naira strengthen against the dollar.

1

3

4

Trump is breathing life back into the Monroe Doctrine to build an international order based on regional spheres of influence. Is it rational? The data say yes. Here’s my piece for Chatham House… https://t.co/99ErYbTROz

chathamhouse.org

President Trump’s actions seem to indicate a hemispheric US foreign policy emerging. There is a bleak logic behind that approach.

2

5

18

📌“Trump Monroe doktrinini yeniden canlandırmaya çalışıyor, bu süreçte Türkiye’nin AB ile ilişkileri sıkı tutması önemli” dedi ☝🏻Chatham House Kıdemli Araştırmacısı @davidlubin ve ekledi: 📌“Türkiye’de dezenflasyon beklentilerden yavaş gitse de herkes Şimşek’in uyguladığı

0

2

9

Event | Can China still prosper under Xi? Experts join @benjaminbland (@CHAsiaPacific) to discuss the challenges facing 🇨🇳 under Xi Jinping's leadership, with: ▪️@davidlubin ▪️@DrWinnieKing ▪️@DesmondShum Date📅: 24 September Time⌚️: 14:00 https://t.co/R8YPxKylKS

chathamhouse.org

Experts discuss the current direction and challenges facing China’s leadership under Xi Jinping.

0

5

12

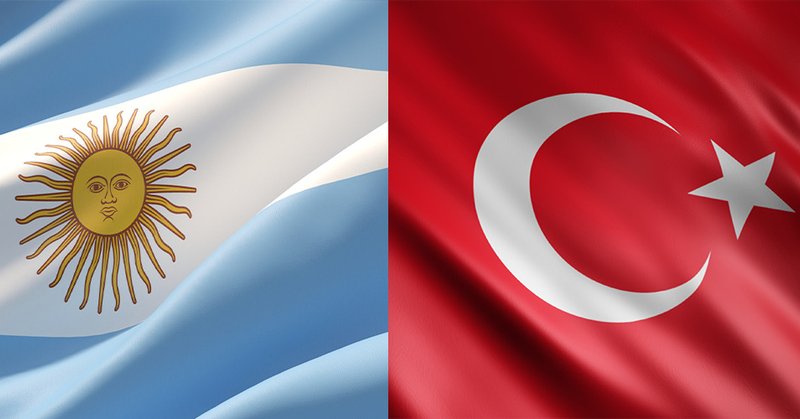

Argentina vs Turkey; shock therapy vs gradualism. Who will succeed? I think Turkey, but not because there’s anything so great about gradualism. Rather, it’s the politics and geopolitics surrounding the adjustment that give Turkey the edge. https://t.co/Xjd7MCGTFr

omfif.org

Milei and Erdoğan take contrasting approaches to economic problems

0

2

10

I’m taking part in this interesting discussion tomorrow on global economic policy. Online participants still welcome! https://t.co/kNxFJmcG4S

chathamhouse.org

A pre-Davos discussion on current challenges and their impact on the future of the global macroeconomic consensus framework.

0

0

3

For more than a year, the net flow of foreign direct investment into China has been increasingly negative. In the three months to September, foreign firms withdrew $12 billion, writes @davidlubin (@ch_gef). https://t.co/My1Tpl0oki

chathamhouse.org

Capital is leaving the country, but some net FDI outflows to other manufacturing destinations allow Chinese firms to avoid trade friction with the US.

0

5

10

‘Global South’ is trending, but ‘Emerging Markets’ has lost its buzz. That switch is not trivial, but reflects the triumph of politics over economics. My piece in today’s FT… https://t.co/beFsZDjpqk

ft.com

The shift away from emerging markets reflects an eclipsing of economics by politics

0

0

7

Some personal news: as you can hear from @bronwenmaddox at the start of this podcast on China, I’m about to join Chatham House as a Senior Research Fellow. Very, very excited! https://t.co/lSiRE1Tuk7

podcasts.apple.com

Podcast Episode · Independent Thinking · 23/11/2023 · 29m

0

3

12

Has the world trade recession already started? My piece in today’s FT. Has the global trade recession already started?

0

0

1

Hear emerging markets (EM) experts on China and India, sovereign debt, the US dollar and more in this week’s podcast. Moody’s Scott Phillips is joined by Lee C. Buchheit and @davidlubin 👉 Listen here: https://t.co/t7uhaVp8uN

#EmergingMarkets #Podcast #MoodysTalks

1

2

5

Are all Chinese economic recoveries alike? I don’t think so: the 2023 recovery will be quite different to the past, with less impact on the rest of the world. My piece in today’s FT. China’s recovery might be a bit less than meets the eye

ft.com

Investors should not assume this upturn in economic growth will be just like previous ones

3

1

2

@davidlubin will be speaking on ‘China’s economy: towards self-reliance?’ for the next Monday *in-person* seminar of @SOAS_CI (5-6:30 pm, 14 Nov, Room RB01, Russell Square: College Buildings). All welcome. Seating first-come first-served. Register here:

soas.ac.uk

China’s economy has exhibited an inward tilt since the 2008 Global Financial Crisis, but the nature of that tilt has changed in recent years, since geopolitics and ideology are increasingly shaping...

0

1

1

The increased role of geopolitics and ideology in Beijing’s economic decision-making is bad news not just for China but for the world, writes @davidlubin (@ch_gef). https://t.co/gQL1r97p2s

chathamhouse.org

The increased role of geopolitics and ideology in Beijing’s economic decision-making is bad news not just for China but for the world.

0

4

7

Chinese policymaking has become more inward-looking since the 2008 financial crisis, but geopolitics is really reinforcing this now. My piece for Chatham House here, out today.

chathamhouse.org

The increased role of geopolitics and ideology in Beijing’s economic decision-making is bad news not just for China but for the world.

0

0

0

In a higher inflation world, a stronger dollar might hit emerging economies harder this cycle, argues @citi's @davidlubin in this @FT column. Striking chart too from @RayDouglasUK

https://t.co/jyORg7Tpkm

1

3

4

Two years ago I was pretty sure people were over-worrying about the risk of debt crisis in low-income developing countries. Now I’m not so sure. My piece in today’s FT. Is it time to worry about an emerging markets crisis?

0

0

4