New rentals are decent and move-outs have slowed. Strange considering it's one of my more podunk locations.

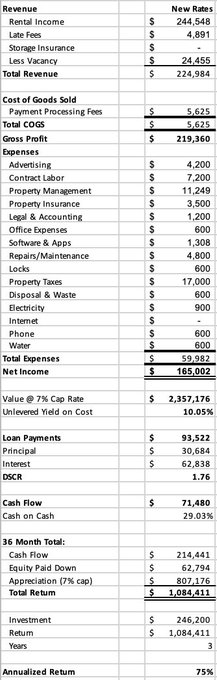

If rev flatlines @ $21k/mo, expenses kept to 30% (expect lower), it'll gen:

- $252k rev

- $176k net income

- $83k cash flow

- 35% cash on cash return

Yahtzee!

7

3

264

Replies

Bought my 6th crappy storage property 6 months ago.

"Overpaid" at a face-melting 3.6% cap rate, watched 80 yr old seller laugh all the way to the bank, then went to work.

After shedding some blood, sweat, and a few tears, I'm now chuckling a bit too.

The story of

#6

:

⬇️

60

68

2K

Feb 2021: Get a State of Market email from a storage broker on my turf.

Resist delete reflex, instead respond: "Excellent report! If you ever have a super crappy one to sell, here's my crap-teria: ..."

Broker quickly responds: "Have I got a perfectly crappy one for you!"

3

0

65

I'm kinda a connoisseur of crappy storage and this was one to behold:

- No books just tax returns

- $60k back rent, no lockouts/auctions

- cash/check only

- begrudgingly managed by extended fam

- burglarized weekly

- wrong name & address on Google

- units tracked by whiteboard

7

1

117

Owner is an absentee 80 yo, 1600 miles away, husband built 30 yrs ago (RIP), local neph manages.

Books don't exist but I've got all I need with a unit mix.

Lick finger, raise to air, plug guesses into magic spreadsheet, make offer, negotiate, agree to $1.55m for 40k sq ft.

1

1

79

100% occupied & rent roll of $15k/mo but lax collections means only ~$10k/mo was coming in.

Guessed I could get rev to $20k/mo if I:

- Raise rent

- Kick out deadbeats

- Backfill @ higher prices

- Require rent be paid

Results of my guesses below:

7

2

154

I have some side cheese but don't have $1.55m laying around so I had to go find someone to lend it to me.

At this point, I'd financed 2 buys with Local Bank 1, 2 w/ Local Bank 2, and one with a seller.

Decided to introduce banks 1 & 2 to each other and let them duke it out.

1

0

64

Bank 2 came out swinging:

SBA 7a loan: 10% down, 4.55%, 25 yr am, 10 yr adjust.

The catch: I had to refi the other 2 and move them from Bank 1.

They won. Refi'd the two, rate unchanged, pulled out a buncha cash, extended adjust to 10 yrs on both.

We're besties now.

5

2

141

Ended up putting $234k of my own bags into the deal:

$155k down

$37k closing costs

$40k new gate/fence

$2k for signs

Closing statement in case you want to see the deets.

2

3

97

Closed June, sent broker extra $2k thank you, cleaned house, now runs smooth as buttah and beating most of my guesses:

- Collected $21k in Dec

- Rent roll now $19k @ 90% occupancy

- Rolled out insurance, now generating $1800/mo

- Collecting $500-800/mo in fees from late payers

6

1

114

If you like stories like this, hook me up with follow, RT the tweet below, or send a DM if that's your thing.

Bought my 6th crappy storage property 6 months ago.

"Overpaid" at a face-melting 3.6% cap rate, watched 80 yr old seller laugh all the way to the bank, then went to work.

After shedding some blood, sweat, and a few tears, I'm now chuckling a bit too.

The story of

#6

:

⬇️

60

68

2K

15

7

115

3

1

45

@mhprvpmvp

Bro, I checked your profile yesterday and it was so professional and even had your real name. Today, not so much.

1

0

2

@SultanofStorage

My $0.02.

- Use a top tier management software with street rate management.

- Try hard to get tenants on CC autopay.

- Website with online move-ins.

- Implement auto-rent increases.

- Fair but strict auction timing.

- Every unit is cleaned and ready for re-rent within 2 days.

0

0

0