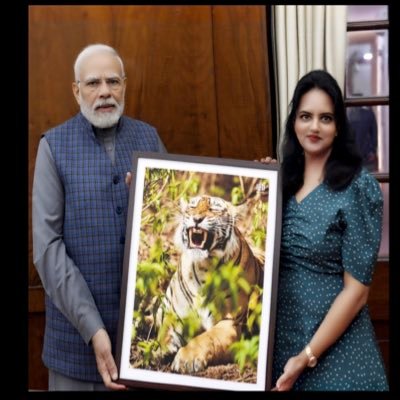

✨kiran✨

@Kiran255050

Followers

2K

Following

7K

Media

47

Statuses

5K

Nationalist🇮🇳 Sanatan Dharma🚩 ×No Dm×👏

Joined January 2022

When propaganda meets due diligence, truth always wins. The truth is simple: under Modi, Indian institutions earn; under Congress, they bled. The toolkit may be global, but India’s resilience is national, and it’s stronger than every lie printed in Washington.

11

195

222

#WashingtonPostExposed In its report, the Washington Post implied risk from LIC's Adani bond subscription. But look at what LIC actually did: Portfolio value rose from ₹38,471 crore to ₹61,210 crore in FY 23-24 Major holdings surged: Ports (+83%), Enterprises (+68.4%),

21

132

142

#WashingtonPostExposed Every foreign “attack” on #Adani followed the same playbook: ➡ Target Indian success ➡ Question Indian institutions ➡ Twist the truth into a headline But truth doesn’t panic. It prevails. Adani stands tall — and so does India.

5

90

99

The Pattern Is Clear. First the foreign forces: Reuters, Financial Times, Washington Post, Hindenburg, George Soros went after #Adani’s projects. Then his partners. Then his investors like LIC. Even India’s courts and regulators were smeared. Each time, facts beat propaganda.

5

54

63

#WashingtonPostExposed

#LIC Data and #Adani's Performance Defend Themselves In one year, LIC’s Adani holdings jumped from ₹38,471 crore to ₹61,210 crore. That’s a ₹22,400 crore value gain. Add to it ₹6,400 crore in booked profits—and the “bailout” claim collapses.

0

50

55

#WashingtonPostExposed For too long, foreign media framed India’s success as “suspicious.” Now Indians are done apologizing for winning. The #Adani story isn’t about one businessman — it’s about a nation refusing to bow to biased narratives. #India is done with imported

9

65

75

The Washington Post labeled LIC’s ₹5,000 crore investment in Adani Ports & SEZ a “bailout.” The truth: It’s a 15-year bond at 7.75% yield, backed by an infrastructure leader. LIC’s holdings in the #AdaniGroup rose by 59% in FY 2023-24 — from ₹38,471 crore to ₹61,210 crore.

2

73

70

This is Performance, Not Patronage LIC’s Adani investments weren’t a rescue—they were a profit booking opportunity. FY 2023-24 results: 🔹 Portfolio value + 59 % 🔹 ₹22,400 crore added 🔹 ₹6,400 crore profit realized That’s portfolio management, not political management.

4

67

72

Critics blamed LIC for backing Adani. But they missed the plot (perhaps deliberately). Turns out, LIC laughed all the way to the bank. 🟢 ₹22,000 crore jump in portfolio value 🟢 ₹6,400 crore in profits 🟢 7.75% bond yield secured That’s not a bailout. That’s financial

10

71

74

वॉशिंगटन पोस्ट का हिट जॉब बनाम सच्चाई वॉशिंगटन पोस्ट ने मई 2025 में एलआईसी द्वारा अडानी ग्रुप के बॉन्ड में किए गए निवेश को गलत बेलआउट बताया है। लेकिन असलियत बिल्कुल अलग है। एलआईसी का यह निवेश पूरी तरह नियमों के अनुसार और पॉलिसीधारकों के लिए सुरक्षित, लंबे समय का रिटर्न देने वाला

17

171

260

कुछ लोग एलआईसी के अडानी ग्रुप में निवेश को एक व्यक्ति को फ़ायदा पहुंचाने वाला कदम बताकर भ्रम फैला रहे हैं, जबकि हकीकत इसके बिल्कुल उलट है। एलआईसी का यह निवेश भारत के महत्वपूर्ण राष्ट्रीय उद्योगों को मजबूती देने वाला कदम है, जिसने कंपनी को भारी मुनाफा भी दिया है। तथ्य एलआईसी को

9

95

101

Once again, The Washington Post comes up with a baseless hit job against Indian business man Adani. Authored by Ravi Nair — a habitual fake news peddler — this story has zero evidence and full propaganda. Just like the Hindenburg drama, it’s another funded narrative to malign

6

102

108

It’s quite comical that the article against Adani Ji is authored by a random leftist from Kerala, Ravi Nair, yet the ecosystem presents it as if it's been penned by renowned international economists! Nonetheless, let’s discuss some facts: During the Congress administration

8

71

74

When foreign lobbies attack #India’s enterprises, they’re not targeting one group — they’re undermining India’s rise. Reuters, Financial Times, Washington Post, Hindenburg, George Soros are part of the same cabal that wants to ruin India. But each attempt to break confidence

6

94

95

The Myth vs. The Math They called LIC holdings in Adani a bailout. But the numbers tell a different story. LIC’s Adani portfolio surged 59% in FY2023–24 ₹6,400 crore profit booked ₹5,000 crore bond investment at 7.75% yield That’s not rescue — that’s returns. Smart

6

124

122

2004–14: LIC misused by congress for bailouts, grew just 4x while economy grew 6x & markets 10x. Post-2014: LIC’s assets doubled, and by 2022 its market cap beat UPA-era book value. Modi Govt turned LIC from bailout tool ➡️ national wealth creator. 🇮🇳💪 #WashingtonPostExposed

7

81

87

LIC’s investments in Adani aren’t favoritism but smart, strategic bets on India’s core industries. Despite the Hindenburg controversy, global investors and the Supreme Court validated Adani’s position. With record profits and strengthened national infrastructure, LIC’s gains

29

93

107

A hit job by #WashingtonPost has portrayed #LIC’s May 2025 investment in #AdaniGroup bonds as an improper bailout. In reality, LIC’s moves were consistent with its mandate to earn safe, long-term returns for policyholders. Expert analyses and regulatory findings support the

38

132

221

This So-called Pseudo-Scholar and Expert in the Science of Disasters, Ravi Nair, from Kerala, has Presented a Nonsense Article. He Flatters the Congress and the Congress Regime Claiming that between 2004 to 2014, During the Congress Regime, LIC's Assets Grew Fourfold, while the

10

58

60

Funny how the ecosystem is acting like Ravi Nair from Kerala is some global economist. Let’s stick to facts. Between 2004–2014, under Congress rule: – LIC’s assets grew 4x – India’s GDP grew 6x – Equity markets grew 10x LIC’s relative value shrank because it was used to bail

12

91

99