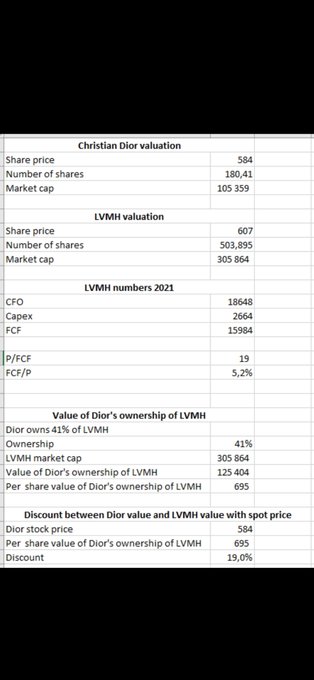

Christian Dior thesis: you get LVMH with a discount. Dior owns 41% of LVMH. LVMH fcf yield : 5,2% with q1 22 sales growth of 23%. L setted up in may 22 a 1 billion € buyback programm with a 1000€ limit.

8

19

166

Replies

@FoxCastlehold

Do you have any insights on Bernard Arnault's potential plans of a takeout of $CDI.PA?

1

0

4

@jefke00

I have no insights but Dior float is very low, financière agache (BA holding) is buying LVMH shares. Dior too bought some lvmh shares albeit lower amounts. There has been a transfer of shares from one entity (agache) to financière de l'agache.

0

0

2

@FoxCastlehold

What if CD has €200bn in liabilities? The analysis is flawed unless it is clear what is behind CD ex LVMH

2

0

2

@hectoretti

Dior consolidated balance sheet (which takes into account lvmh accounts as it is the sole asset) has a net debt linked to the Tiffany acquisition and when you look at off balance sheet items there is nothing special.

1

0

2

@FoxCastlehold

What is it with nerds and holding companies selling at a “discount”? Is it just that the math is easy? 🤷🏻♂️

2

0

0

@FoxCastlehold

one thing though, the majority holder could always opt for a "squeeze-out" at will, but it had to offer a fair market value (suspecting it'd be based on VWAP 14 / 30 of LVMH shares)

0

0

0