DEGIRO

@DEGIRO

Followers

29K

Following

502

Media

687

Statuses

11K

Make the most out of your investments with our low fees and award-winning platform. Investing involves a risk of loss.

Amsterdam

Joined February 2016

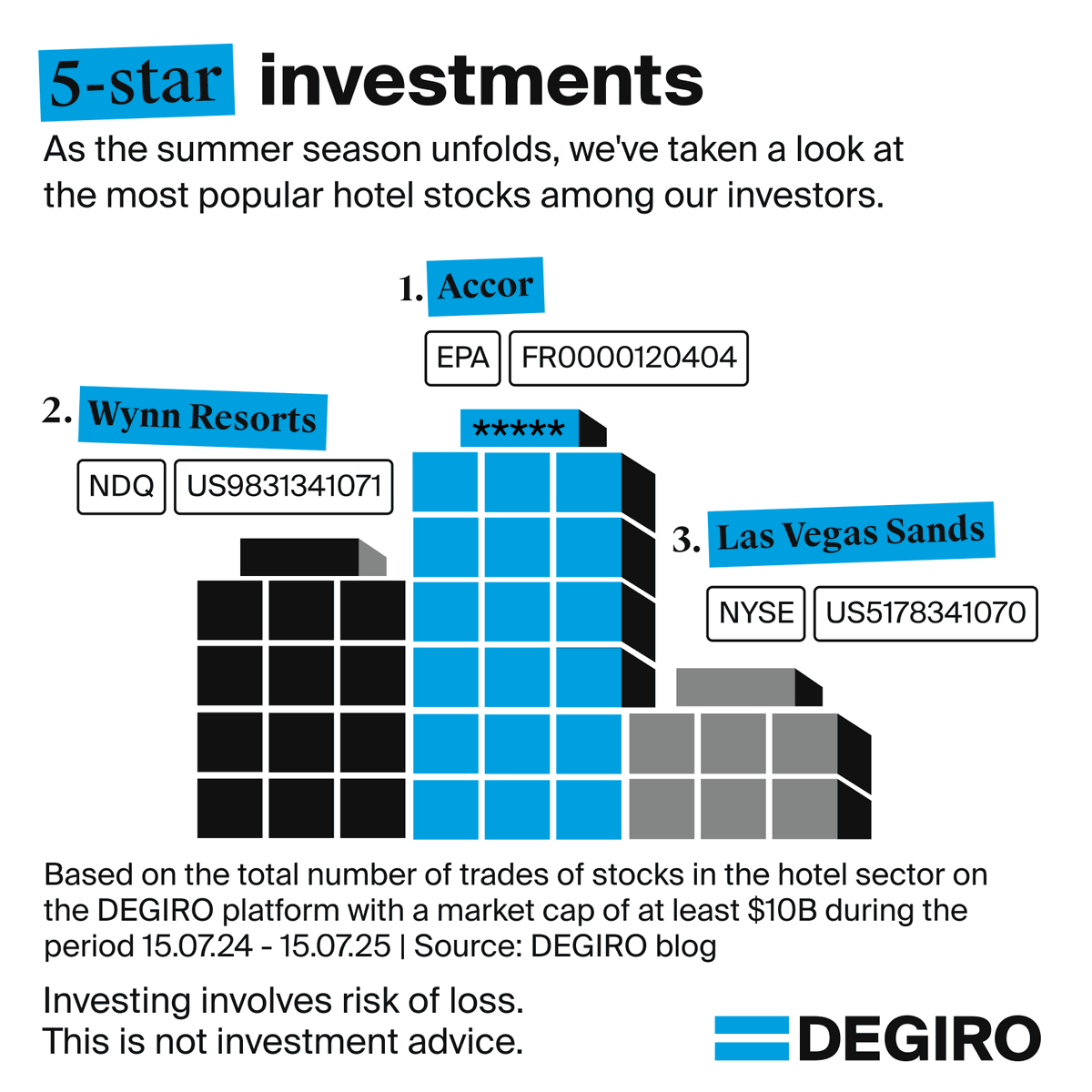

Have any of these stocks checked in your portfolio? The hotel sector presents a unique opportunity for investors, given that global tourism continues to grow. Demand for hotel accommodation remains high, but it’s also dependent on economic conditions. #FinancialLiteracy

2

0

3

Do you think that European stocks are making a comeback? During the first half of the year, they outperformed US peers. They are also gaining popularity among our investors, with 10 out of 15 countries investing in companies from their own country. #FinancialLiteracy #Investing

1

2

11

Are oil prices up for volatile times? Brent crude prices saw a sharp turnaround, following the -7,2% fall in prices. The recovery was driven by political tensions as investors expect supply disruptions to raise oil prices. #FinancialLiteracy #Investing

0

0

5

Is $TSLA in for a bumpy ride? 🚘 CEO Elon Musk publicly fell out with Trump, and Tesla's market cap fell by $150 billion. However, the stock price has risen ahead of the Robotaxi launch and after Musk stated he'd gone too far with some comments. #FinancialLiteracy #Investing

2

1

11

Is your portfolio up for some music? The global music festival market is expected to grow to $3,04 billion in 2025, according to The Business Research Company. This would represent an increase of almost 20% from the previous year. #FinancialLiteracy #Investing

0

0

7

Is the AI craze cooling off? While $NVIDA, $GOOGL and $ASML remain our investors' top picks, interest appears to be shifting. Defence ($RHM, $LDO), healthcare ($NOVC, $OSCR, $UNH) and banking ($ALPHA, $BCP) are gaining ground. #FinancialLiteracy #Investing

0

0

5

Can Europe's oil giants weather another crisis? Although they presented strong balance sheets in their earnings reports, their shares declined as investors were reminded of past downturns that forced spending cuts and rising debt to sustain returns. #FinancialLiteracy #Investing

2

0

4

Will the dollar regain ground? The pause on EU tariffs has caused equities to bounce back from the 23 May shock. However, the USD has not yet recovered, as confidence in the currency has weakened due to inconsistent policymaking, among other reasons. #FinancialLiteracy #Investing

0

0

5

Can Tesla regain its position in the European market? While the European EV segment grew by 28% industry-wide in April, Tesla's car sales registrations plunged by 49%, with Volkswagen selling 61% more electric cars than a year earlier. #FinancialLiteracy #Investing

1

0

5

Could AI data centres be NVIDIA’s next breakthrough? The company is positioning them as its next major growth engine. Data centres generated $115,2B of NVIDIA’s total revenue during the fiscal year 2025, up from $10,6B in fiscal year 2022. #FinancialLiteracy #Investing

4

0

4

Will Shopify keep on soaring? After a US-China trade truce on 12 May, Shopify was one of the leaders of the broader market rally, bouncing back from its April losses. However, tariff uncertainty and mixed Q1 results are still a concern. #FinancialLiteracy #Investing

0

1

5

$NVDA continues to stand out on our trading map. As the announcement of US tariffs rattled the markets, European investors are turning to sectors they see as resilient - and AI remains popular among them. What other sectors are you invested in? #DEGIRO #Investing

2

0

7

Will the Switch 2 replicate the first generation’s success? The pre-sale, postponed amid the tariff turmoil, has pushed Nintendo's market value to $92 billion on 25 April. Despite inflation concerns, consumers are willing to spend on indulgences. #FinancialLiteracy #Investing

0

0

2

Which of these Dutch giants would you pick for your portfolio? $ASML, $BESI and $ADYEN were the most traded Dutch stocks last year. A strong tech showing: from chips to payments, with ASML once again leading the fleet. #FinancialLiteracy #Investing

2

1

6

What does the future hold for Tesla? $TSLA shares are down close to 40% since 2025 due to dramatic sales declines and an increase in competition. CEO’s plan to focus on the company made shares go up despite lower than expected earnings results #FinancialLiteracy #Investing

3

2

5

Will Hermès dominate European luxury? On 15 April, $MC fell 7,8% after disappointing Q1 results, due to slowing demand in China and the US amid trade war threats. Luxury stocks have had a rocky year, but $RMS has surged by catering exclusivity #FinancialLiteracy #Investing

1

1

6